Objective of Compensation System

From the perspective of expanding and strengthening Group business operations and corporate governance towards achieving our long-term vision, we outline the objectives of our plan for remuneration for directors and corporate auditors as the following.

Objectives of our plan for remuneration for directors and corporate auditors (outlined in 2011)

- To ensure compensation levels that enable the hiring of elite internal and external personnel, provide motivation, and promote retention.

- To serve as motivation for achieving short, medium, and long-term targets.

- To ensure appropriate compensation for generated results.

- To fulfill a sense of purpose by sharing accountability for results with shareholders.

- To ensure fair and reasonable practices that enable the fulfillment of accountability to shareholders and all other stakeholders.

Policy on Compensation for Director

Composition of compensation

The compensation of directors (excluding Outside Directors) is comprised of the following three components.

- Basic compensation, which is fixed according to the position and duties

- Performance-linked compensation as a short-term incentive based on corporate and individual performance for the previous fiscal year

- Share compensation as a medium- to long-term incentive that is linked to the performance of the Meiji ROESG® and the Meiji Group's share price trend

Basic compensation and performance-linked compensation is paid in cash, while share compensation is provided by allotting shares with transfer restrictions.

Only basic compensation is paid to Outside Directors and Audit & Supervisory Board Members from the perspective of their roles and independency.

Compensation levels

To ensure compensation levels that enable the hiring of elite internal and external personnel, provide motivation, and promote retention, we reference the following when determining compensation levels for directors.

(Compensation benchmark source)

Compensation governance

The Board of Directors determines the structure for director compensation, the results for company and individual performance, and the amounts of calculated compensation, after hearing the opinion of the Compensation Committee on these matters. The Compensation Committee has the majority of whom are outside directors independent of Meji Holdings Co., Ltd. (the "Company").

Payment Amount Calculation Method of Compensation for Director

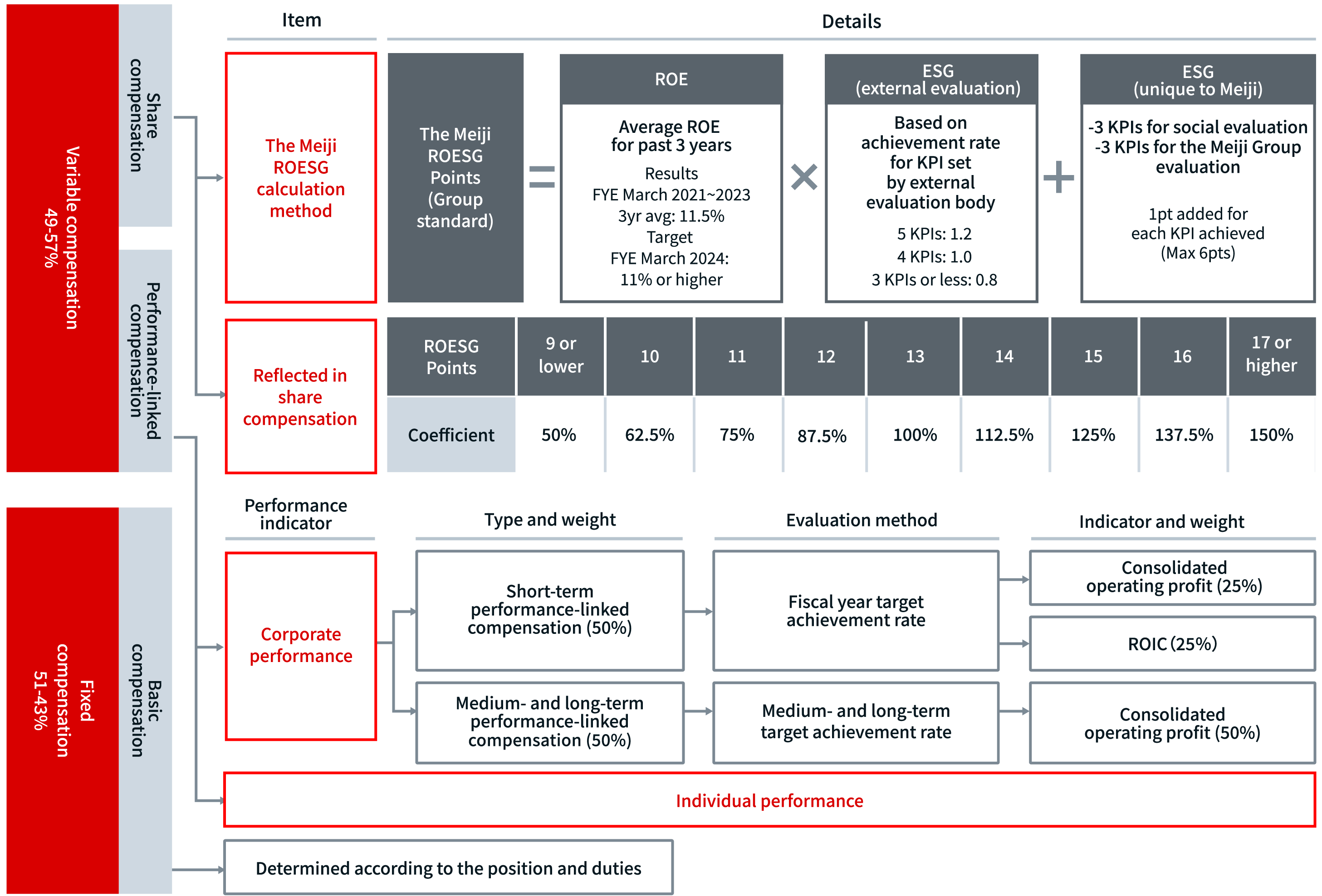

Compensation ratio

To provide incentives to improve the corporate value of the Meiji Group and promote the sharing of interests with shareholders and other stakeholders, we have set the ratio of fixed compensation (basic compensation) to variable compensation (performance-linked compensation and share compensation) at 43-49:57-51 in the amount of remuneration upon achievement of budget targets. Specifically, we apply a higher rate of variable compensation as the rank and position of the executive increases.

Furthermore, the ratio of performance-linked compensation and stock-based compensation within variable compensation is 60:40.

Overview of calculation of director compensation payment amount

Base compensation

Fixed compensation (base compensation) is paid to directors. We determine this amount based on the director's status and responsibilities, and reference compensation levels at major Japanese companies as indicated in data from external research firms as well as compensation levels at major manufacturing companies that are similar to Meiji in business scope, operations, and structure.

Variable compensation

Performance-linked compensation

Objectives

To ensure a commitment to the Meiji Group 2026 Vision and key indicators outlined in our Medium-Term Business Plan, and to increase motivation towards improving performance.

Composition of compensation

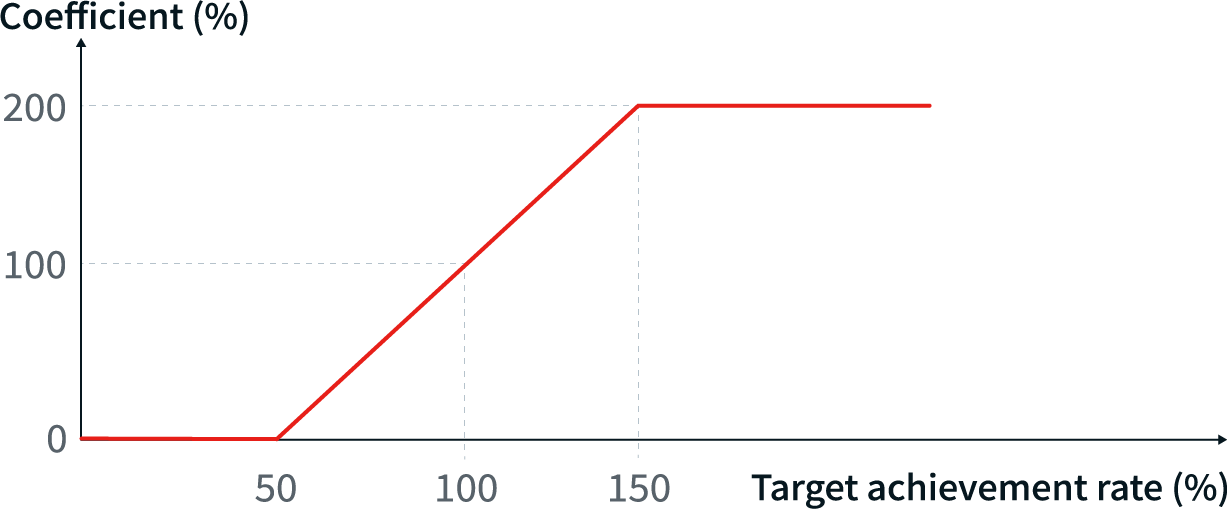

Payment amount calculation method

Coefficient for Consolidated Operating Profit/ROIC

Share compensation

Objectives

To provide incentives to improve the corporate value of the Meiji Group and promote the sharing of interests with shareholders and other stakeholders.

Overview

As a medium- to long-term incentive that is linked to trends in our stock price, we issue transfer restricted shares that cannot be disposed of for the three-year period following allocation (issued once per year after the General Meeting of Shareholders). The amount of monetary compensation claims to be granted by the Company in order to allot transfer restricted shares fluctuates every year according to the results of the Meiji ROESG in the previous fiscal year.

Payment amount calculation method

We set the Meiji ROESG, which is calculated based on ROE figures and the results of ESG initiatives, as a performance indicator. The payment amount is calculated by multiplying the base amount by a coefficient calculated as detailed below:

| Evaluation indicators | FYE March 2025 Target | |

| MSCI ESG Ratings | ESG ratings calculated by MSCI, a financial service firm in the U.S., based on information disclosed by companies | A |

| DJSI | An ESG investment index developed by U.S.-based S&P Dow Jones Indices and RobecoSAM, a Swiss investment advisory company | 68pt or more |

| ISS ESG | Sustainability rating evaluation by the responsible investment arm of Institutional Shareholder Services Inc. | C (43pt or more) |

Policy on Compensation for Corporate Auditors

Details and Total Amount of Compensation of Officers

We disclose the total amount of compensation by officer category and by compensation type, and number of eligible officers. For directors with a total compensation of JPY 100 million or higher, we also disclose their individual amount of compensation. See the Corporate Governance Report ([Director Compensation] on page 28)